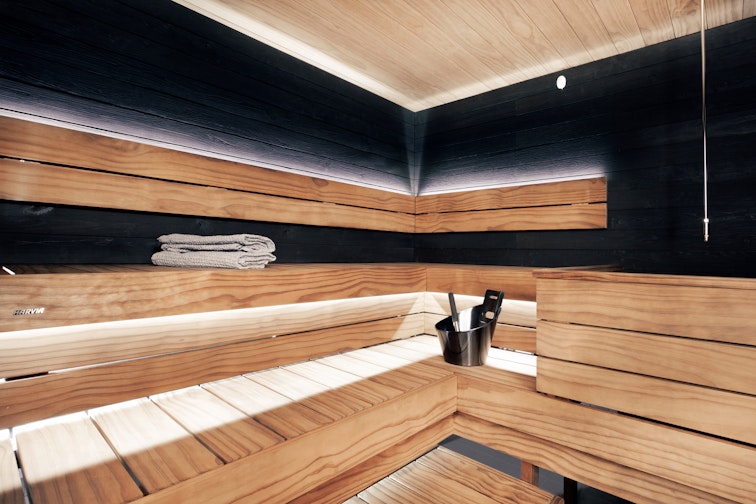

Terveyttä lämmöllä

Intohimomme on jakaa saunan parantavaa lämpöä koko maailmalle ja tuoda rentouttavia hetkiä ja luonnollista hyvinvointia kaikkien saataville.

Harvia-faktoja

Valmistamme yli 20 000 saunaa vuosittain

Valmistamme yli 200 000 kiuasta vuosittain

Meillä on yli 70 vuoden kokemus sauna & spa-alalta

Meillä on asiakkaita yli 80 maassa

Kohokohtia

Harvia Frosty -kylmäallas

Kylmäallas, joka mahdollistaa kylmähoidon osaksi jokapäiväistä arkeasi, omassa kodissasi.

Harvia Spirit - koe löylyn henki

Kompaktin kokoinen design-sähkökiuas, joka yhdistää turvallisuuden ja edistyksellisen teknologian.

Nova höyrysuihkukaappi & -paneeli

Koe ainutlaatuinen höyryelämys

Harvian kiuaskivet

Mitkä kiuaskivet sopivat parhaiten käyttöösi? Tutustu laajaan kiuaskivivalikoimaamme ja löydä oikeat kiuaskivet saunaasi.

Sauna käden ulottuvilla

Voit hallita saunasi toimintoja etänä missä ja milloin vain helposti ja turvallisesti MyHarvia WiFi -ratkaisujen avulla. Rentoudu töiden jälkeen tai palaudu treenin päätteeksi. Nauti saunan parantavasta lämmöstä saunomalla säännöllisesti.

Onko sinulla kysymyksiä tuotteistamme?

Katso useimmin kysytyt kysymykset ja niiden vastaukset täältä